Northern Lakes Economic Alliance • 231-582-6482

Buck Love, Business Retention & Growth

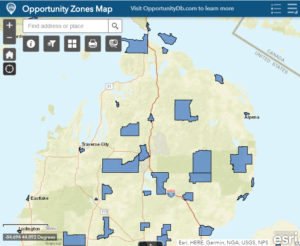

With 3 Opportunity Zones eligible for investment within the NLEA service area, interest is emerging for more information on how this business attraction and tax shelter tool can be used for a business or community’s benefit.

With 3 Opportunity Zones eligible for investment within the NLEA service area, interest is emerging for more information on how this business attraction and tax shelter tool can be used for a business or community’s benefit.

The NLEA is beginning the process of educating ourselves on this business attraction tool to share with others interested in promoting their parcels to qualified Opportunity Zone Fund Managers. The link to these funds is found here: https://opportunitydb.com/funds/ and a general overview of the process is here: https://opportunitydb.com/guide/

Included with these links is this list of Frequently Asked Questions for Opportunity Zones and for more info, subscribe to this newsletter: info@opportunitydb.com

There are many advantages to starting your own Opportunity Zone fund. But there are several complexities to be aware of as well. This FAQ list will provide some answers.

Q: How does a Qualified Opportunity Fund (QOF) get certified?

A: Any partnership or corporation can self-certify as a Qualified Opportunity Fund by filing IRS Form 8996 annually with its federal tax return. Each proposed Opportunity Fund must identify and commit their investments to specific community benefit outcomes. The key is to be able to have a robust audit trail to support the fund’s certification in the event of an IRS challenge. For this reason, it is imperative that your fund’s documentation is prepared properly at the outset.

Q: How long does it take to form a QOF and/or Qualified Opportunity Zone Business (QOZB)?

A: Typically, OZPros.com can deliver your organizing documents within 2 business days for a simple fund. More complex structures may take longer.

Q: Do Opportunity Zone investors need to be accredited?

A: No. That said, most of the syndicated Qualified Opportunity Fund offerings are performed via SEC Regulation D, Rule 506(c), which requires that all investors be accredited. But non-accredited investors can participate in a direct placement deal by creating their own Qualified Opportunity Fund.

Q: Can an investor invest directly into an Opportunity Zone business to qualify for associated tax incentives?

A: No, an investor can invest in a Qualified Opportunity Zone Business (QOZB) only through a Qualified Opportunity Fund (QOF) in order to qualify for associated tax incentives.

Q: What can Qualified Opportunity Funds invest in?

A: Qualified Opportunity Funds (QOFs) can invest in any Qualified Opportunity Zone Property (QOZP), including stocks, partnership interest or business property (so long as property use commences with the fund, or if the fund makes significant improvements to the qualifying property). The typical best practice structure is for the QOF to own a Qualified Opportunity Zone Business (QOZB), which owns Qualified Opportunity Zone Business Property (QOZBP). See the below answer for additional information.

Q: Does my Opportunity Zone fund need an underlying QOZB entity?

A: No, but the best practice will be to have an underlying Qualified Opportunity Zone Business (QOZB) entity in order to take advantage of the 70% asset test at the QOZB level, as opposed to the 90% asset test at the QOF level.

Q: Should my QOF be an LLC or a corporation?

A: Typically, the QOF should be an LLC. Most QOFs will want passthrough tax status and not be burdened with double taxation on distributions. For funds that invest in an operating business (as opposed to real estate), it oftentimes is beneficial to set up the fund’s underlying QOZB entity as a C-Corp to obtain a tax arbitrage benefit.

Q: Should I be concerned about having to hold the Opportunity Zone investment for at least 10 years?

A: Absolutely not. Instead of thinking, “How long do I have to hold this?” you should be thinking, “How long can I hold this?” The IRS has basically created what we have termed the OZ Self-Directed Super Roth IRA™ with the Opportunity Zone incentive. You get to invest with tax-advantaged dollars. The appreciation of the new investment grows tax-free, and (if held for 10+ years) the money comes out tax-free as well. Tax-free compounding is the eighth wonder of the world, as it is a significant wealth creation opportunity. Investors should be figuring out how they can keep their investments inside of such tax-advantaged vehicles for as long as possible

The link to the maps of Opportunity Zones within the state of Michigan is here: https://opportunitydb.com/location/michigan/