Northern Lakes Economic Alliance • 231-582-6482 • info@northernlakes.net

Jessica Lovay, Office Manager/Grant Administrator

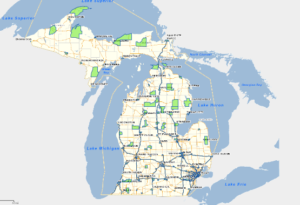

Map of Michigan’s Opportunity Zones.

Recently Northern Lakes Economic Alliance (NLEA) staff attended a training facilitated by partner MSU Extension (MSUE) with collaboration from Michigan Economic Development Corporation (MEDC) and Michigan State Housing Development Authority (MSHDA), on Opportunity Zones (OZ) and what that means to a community.

What is an Opportunity Zone?

An OZ is a Governor nominated zone—based on census tracts—that is an economically distressed community, as determined by 2017 Tax Cuts and Jobs Act. In the NLEA region, there are three zones: Mancelona, East Jordan, and Cheboygan. “The intent of opportunity zones is to connect potential investors with capital gains to re-invest with economically distressed communities who could benefit from that investment” (MSUE Opportunity Zone Training).

What can a community do to attract those investments?

Marketing your zones is the simplest way to attract investment. Each zone can market its assets such as; infrastructure (water, sewer, electricity, etc.); major road, airport, and rail access; site grading; and even community assets like workforce availability, housing, parks, and recreation, etc.

By packaging all these together with photos to entice a developer, a community is more likely to attract those dollars than a community just hoping someone drives by.

Benefits to investors

Once an investor realizes capital gains they can invest in an Opportunity Fund. Those funds are then used as equity in one of three ways:

- Stocks of companies in an OZ.

- Business properties in OZ.

- Partnership interest in qualified business.

There is a basic timeline of tax benefit for investing in an OZ.

- Reinvest realized capital gain in an OZ fund

- 5 years later, tax on original capital gains is reduced by 10%

- 2 more years later, tax on original capital gains is reduced by an additional 5% (total 15%)

- 1 more year, deferred capital gains are recognized. Pay 85% of original capital gain.

- 10 years after original investment, can sell OZ fund interest-free of US federal income tax.

Opportunity Zones are still new to economic development and their full potential is yet to be realized. For more information and an interactive map of Michigan’s Opportunity Zones click here.