By Buck Love, Business Retention and Growth

What is a Tax Abatement?

What is a tax abatement, how do they work, and why are they used? A basic understanding of these questions will help dispel any negative connotations and misconceptions that tax abatements take money away from local communities. Tax abatements actually help to increase the tax base for a local unit of government (LUG). In Michigan all tax abatement decisions and applications are guided by Public Act 198 of 1974 as amended. Industrial Facilities Exemption (michigan.gov)

An Abatement is defined as a reduction, decrease, suppression or termination. The biggest misconception is that local taxing authorities are eliminating or reducing existing tax liability for the applicant, most frequently a manufacturer with substantial assessed value. This misunderstanding can have tax paying citizens question why their local unit of government would grant an abatement to a company.

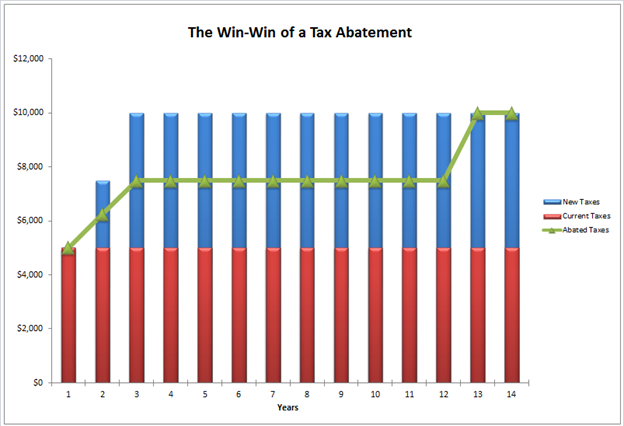

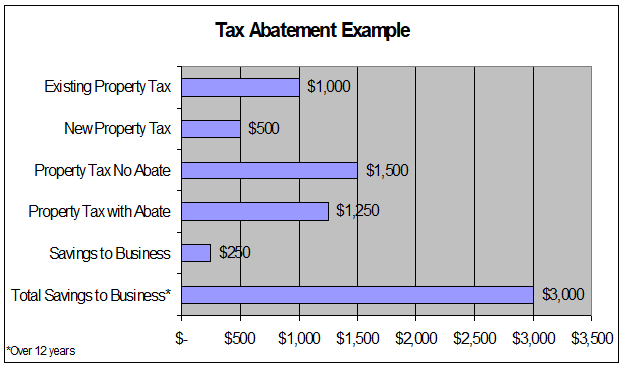

To avoid confusion, you must understand that a tax abatement (aka Industrial Facilities Exception Certificates or IFEC) is only a reduction of local property taxes owners pay on new construction, rehabilitation and/or major improvements to real property. The companies’ current tax base remains the same while up to half of the taxes on the new real property investment value are abated for up to 12 years. Tax abatements are an important and effective tool local units of government can offer as an incentive for manufacturing companies to locate, expand or renovate facilities in Michigan.

Who Can Apply for an Abatement?

- Eligible businesses are generally only “manufacturers,” which the law defines as businesses that make a product by physical or chemical change.

- Also included: related facilities of Michigan manufacturers, privately held electronic generation plants (until 2007), and “high-technology” businesses as defined by the Michigan Economic Growth Act, and others.

The NLEA provides a fee for service to companies wanting to apply for an abatement. The most important point to consider is that the company must request a public hearing from their township or local unit of government to allow for public input of granting an Industrial Development District (IDD) before beginning any construction on a new expansion/rehabilitation project.

What is the process?

- An eligible business files a written request with the local unit to establish an Industrial Development District (IDD).

- The local unit holds a public hearing and adopts a resolution to establish the district.

- The local unit holds a public hearing to consider the tax abatement.

- The local unit determines the length of the tax abatement and any conditions that must be met by the company. They adopt a resolution approving the tax abatement.

- An application is filed with the State Tax Commission.

- The STC and the MEDC review the application. If it complies an Industrial Facilities Exemption Certificate (IFEC) is issued.

What does a local unit of government receive by offering industrial property tax abatements?

- The opportunity to promote economic development.

- Preservation of current local tax base and provide for future tax revenue increases.

- Ability to attract new businesses, keep businesses and to target the type of businesses they want to attract.

- Incentive for business to compete for jobs with other states and countries that have lower taxes rates.

- Rewarding a company that has been a good corporate citizen.

- Annual salaries of the new and retained jobs flow into the local community.

- Other business factors may dictate where a company locates, but tax incentives are one of the key considerations for a company to remain competitive, continue in business and maintain their local employment.

Conclusion: To recap, tax abatements are a positive tool used by local units of government to encourage investment in their community. A company may be facing a gap in project funding and the reduction in taxes for the new improvements following company investment may be enough to fill their need. The growth of Michigan companies means potential for new jobs and new opportunities for local and regional residents.

For more information on establishing an Industrial Development District and applying for an Industrial Facilities Exemption Certificate contact buck@northernlakes.net .